快问快答

- 打工能财富自由吗?

- 能。

- 靠工资能财富自由吗?

- 不能。

在赚钱这件事上,大多数人都是小白。因为学校和家长都不会教你,所以很多人自然会认为:财富积累就是靠每年涨点工资,再定期做点固定储蓄。

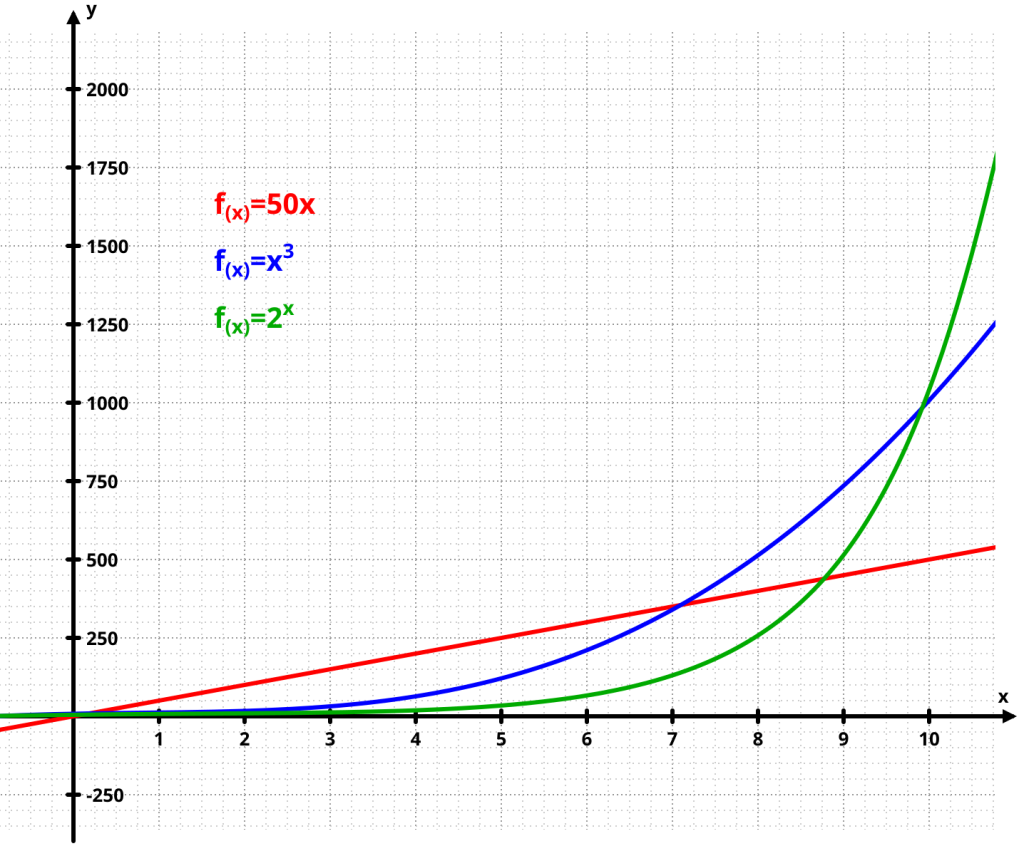

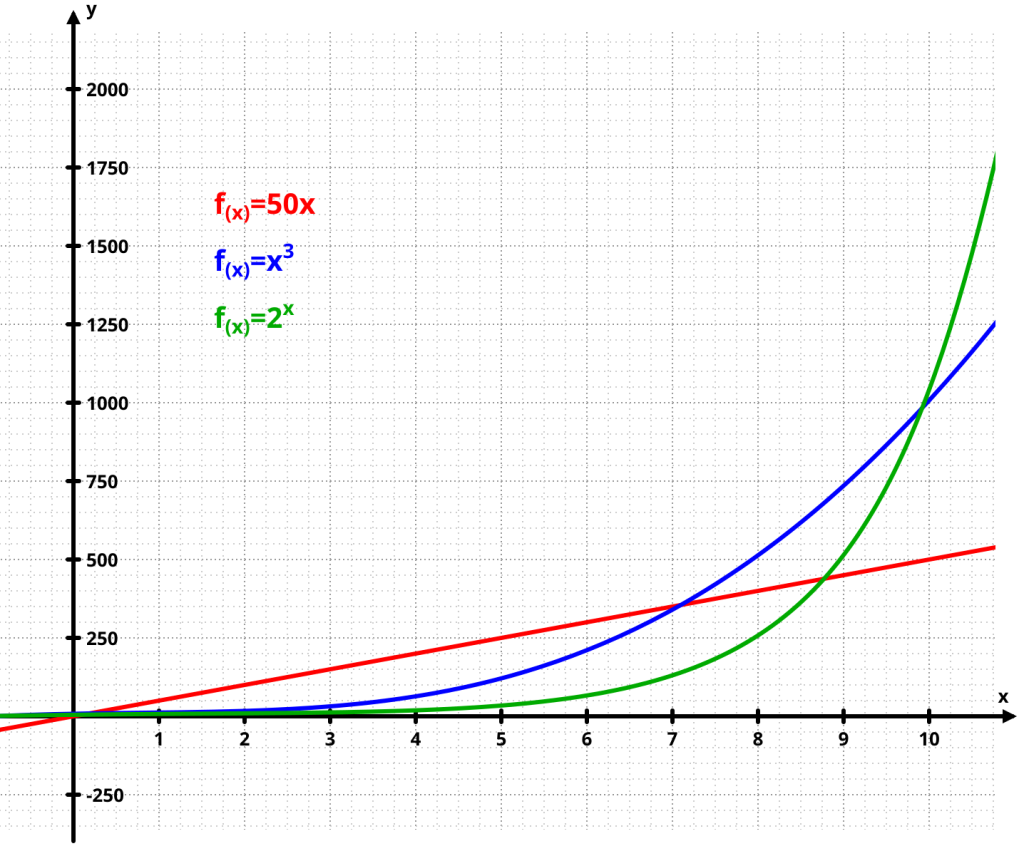

这种思维其实是线性增长模型。但真正通向财富自由的,是复利式增长模型。

举个典型案例:

一位在阿里巴巴工作十年累计收入达千万的工程师,他的实际收入构成是:

基本工资:月薪仅1-2万(10年工资总收入约200万)。

核心来源:期权套现800万(占1000万总资产的80%)。

两个增长模型的对比:

线性增长:缓慢匀速增长(例:10年积累200万)。

复利式增长:前期增长平缓,后期爆发式跃升(例:10年达成1000万)。

结论

打工人的财富自由要依赖指数型增长要素(如股权、期权),而不能单纯地依靠工资的积累。

画个饼:下期讲讲如何在职场获得指数型的增长要素。

Quick Q&A

- Can working a job lead to financial independence?

Yes. - Can relying only on salary lead to financial independence?

No.

When it comes to making money, most people are beginners. Schools and parents don’t teach this, so many naturally believe wealth is built by getting a yearly raise and saving regularly.

This way of thinking is actually a linear growth model. But the real path to financial independence is through an exponential growth model.

A typical case:

An Amazon engineer earned a total of 10 million over ten years. His income breakdown was:

Base salary: only 10k–20k per month (about 2 million in ten years).

Core source: stock options cashed out at 8 million (80% of the total 10 million).

Two growth models compared:

Linear growth: slow and steady (e.g., 2 million in 10 years).

Exponential growth: flat in the early stage, explosive in the later stage (e.g., 10 million in 10 years).

Conclusion

For employees, financial independence depends on exponential growth factors (such as equity or stock options), not just on accumulating salary.

Stay tuned: next time we’ll talk about how to secure exponential growth opportunities in your career.

发表回复